Beijing, Sept. 18 (Zuo Yukun), the client of Zhongxin. com, was a top 100 real estate enterprises and a billionaire on Hurun’s rich list two years ago. Two years later, he became a "Lao Lai" who was offered a reward of tens of millions of dollars and his property was auctioned. What happened to Chen Jianming, the real controller of ST Zhongchang, a listed company, in the past two years?

Billionaire property was auctioned and issued by the court.Ten million reward announcement

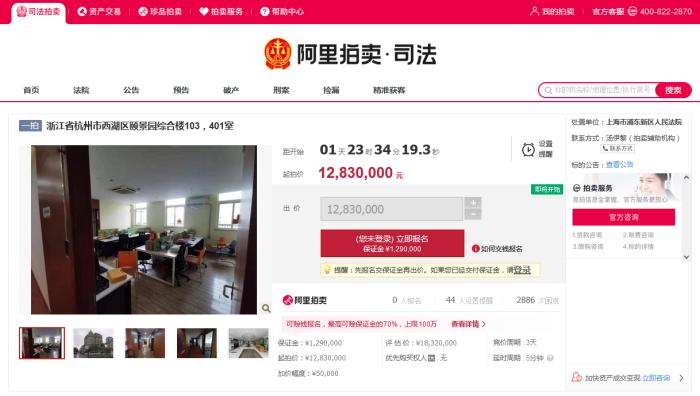

Recently, Alibaba’s auction platform shows that in the next 25 days, four courts will auction several properties and parking spaces under the names of Chen Jianming and affiliated companies in five cases, with a total starting price of nearly 280 million yuan.

One of the properties auctioned in Chen Jianming. screenshot

Chen Jianming is the real controller of ST Zhongchang, a A-share listed company. Sansheng Hongye, who is in charge, was among the "Top 100 Real Estate Enterprises in China" in 2018, and was ranked 398th on the Hurun Rich List with 10 billion assets in 2019.

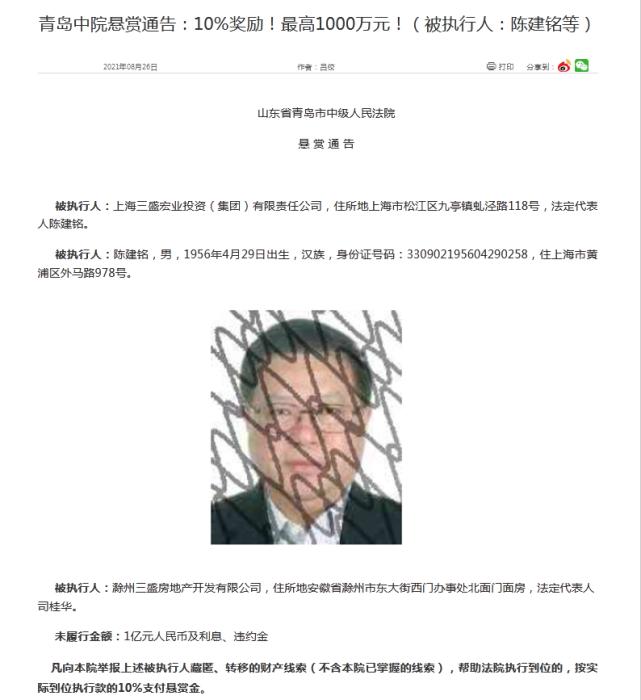

But not long ago, a reward notice issued by the Intermediate People’s Court of Qingdao, Shandong Province (referred to as "Qingdao Intermediate People’s Court") attracted much attention: because the executed person refused to pay 100 million yuan in debt, interest and liquidated damages, the executor applied to the court to issue an execution reward notice to collect clues about the property of the executed person, and paid a reward of 10% of the actual execution amount, that is, the maximum amount of 10 million yuan.

Chen Jianming was offered a reward of 10 million this time because of a dispute over private lending. According to the judgment document, in July 2019, Shanghai Sansheng Hongye Investment (Group) Co., Ltd. borrowed 100 million yuan from Qingdao Tiantai Real Estate Development Co., Ltd. and Qingdao Tiantai Real Estate Co., Ltd. for working capital turnover, with a loan period of 15 days. However, after Sansheng Hongye repaid the interest of 3 million yuan, it failed to return the principal and interest, and Chen Jianming and others were jointly and severally liable as guarantors.

If you don’t be a pig on the tuyere, you can’t be an eagle on the tuyere.

According to public information, Chen Jianming was born in Zhejiang in 1956, went into business in 1993, and then set foot in real estate business. Yijingyuan, three sheng Real Estate and Sansheng Hongye Investment Group are his representative projects. In 2007, Chen Jianming listed Zhongchang by sea through the backdoor of Hualong Group, which mainly focuses on aquaculture.

"We don’t want to be pigs on the tuyere, we want to be eagles on the tuyere." At the mid-term meeting of the company in 2015, Chen Jianming once said to employees: Pigs can’t fly. If pigs fly, they will eventually die miserably; You must become an eagle and learn the skills of flying in order to break through the bottleneck of the industry.

Notice of reward issued by the Intermediate People’s Court of Qingdao City, Shandong Province. Screenshot from official website, Qingdao Intermediate People’s Court

But Chen Jianming, who wanted to be an eagle, failed to fly. After putting forward the "three-year, 100-billion-yuan" plan, Chen Jianming has made huge acquisitions and large-scale land purchases, leaving the company in debt.

According to the information disclosed by the Shanghai Stock Exchange, from April 2016 to August 2019, Sansheng Hongye issued 9.38 billion yuan of bonds with an interest rate of 7%-8.4%, and most of the financing proceeds were invested in real estate projects in third-and fourth-tier cities such as Zhoushan, Foshan and Shenyang.

The pressure of debt repayment is rising rapidly, and Chen Jianming also "borrows money" from employees and issues loans under the name of wealth management products. Thousands of employees and their families have invested a total of 800 million yuan, of which about 680 million yuan of employee financial principal has not been paid, which also staged a scene of "the company thundered, all parties begged for money, and the chairman cried".

At that time, some people in the industry commented that when the turning point of capital trend "going to real estate" came, if you don’t understand the times and don’t conform to the general trend, you are still desperately adding leverage until the debt reaches several times the net assets, and the sales of commercial housing can’t be as capricious as in the past, and you will have to bear the consequences of the break of the capital chain.

In January 2021, Sansheng Hongye filed for bankruptcy. At the end of May, Chen Jianming’s former manipulation and control of ST Zhongchang’s share price was "blacked out" by the CSRC, with more than 11 million illegal gains confiscated and banned from the securities market for 10 years.

In addition, from 2019 to now, Chen Jianming has been issued with 11 restraining orders by the court, and has been executed for breach of trust for 11 times, with a non-performance ratio of 100%, and the total amount of execution exceeded 13.2 billion yuan.

"I am also very sad. If those projects can be solved, I think they can always be solved." At the scene of debt collection in 2019, Chen Jianming said this in tears. But two years have passed, but only ten million reward notices and real estate have been auctioned. (End)