Cao Jianming visited and expressed condolences to the leaders of the Supreme People’s Procuratorate on behalf of all procuratorial police officers to extend New Year greetings.

On the eve of the Spring Festival, Cao Jianming, Party Secretary and Procurator-General of the Supreme People’s Procuratorate, visited or telephoned to express condolences to Comrade Zhang Siqing, Han Zhubin and Jia Chunwang, and extended sincere greetings and New Year wishes to the old leaders on behalf of the Supreme Procuratorate Party Group and all procuratorial police officers. [detailed]

Cao Jianming presided over a symposium of some NPC deputies to solicit opinions and suggestions on the work report.

On the afternoon of February 11th, Cao Jianming, Party Secretary and Procurator-General of the Supreme People’s Procuratorate, hosted a symposium for some NPC deputies in Beijing to solicit opinions and suggestions on the Work Report of the Supreme People’s Procuratorate (Draft for Comment). [detailed]

The Supreme People’s Procuratorate supervised 33 clues of public interest litigation cases that damaged the ecological environment.

In order to fully perform the duty of protecting public interests and further strengthen the handling of cases, the Civil Administrative Procuratorate Office of the Supreme People’s Procuratorate issued a notice and decided to supervise 33 clues of public interest litigation cases that damaged the ecological environment. These clues were discovered by the Supreme People’s Procuratorate in sorting out the supervised cases since 2017 and the recent news media disclosure of relevant issues of concern to all sectors of society. [detailed]

Supreme inspection: further strict discipline and rules to ensure a clean and upright atmosphere during the Spring Festival.

The Spring Festival of 2018 is approaching. In order to thoroughly implement the spirit of the eight central regulations and their detailed rules for implementation, further strictly observe discipline and rules, prevent the rebound of the "four winds" issue and ensure a clean and upright atmosphere during the Spring Festival, the Supreme People’s Procuratorate recently reported seven mental problems of prosecutors violating the eight central regulations. [detailed]

The national procuratorial organs’ special supervision activities to help solve the problem of migrant workers’ wages have achieved remarkable results.

On February 15, 2018, the national procuratorial organs’ two-month special supervision activities to help solve the problem of migrant workers’ wages came to an end. The Supreme People’s Procuratorate will conscientiously sum up experience, establish and improve a long-term mechanism for normalization of procuratorial supervision, prevent and punish malicious unpaid wages, and make it no longer difficult for migrant workers to ask for wages. [detailed]

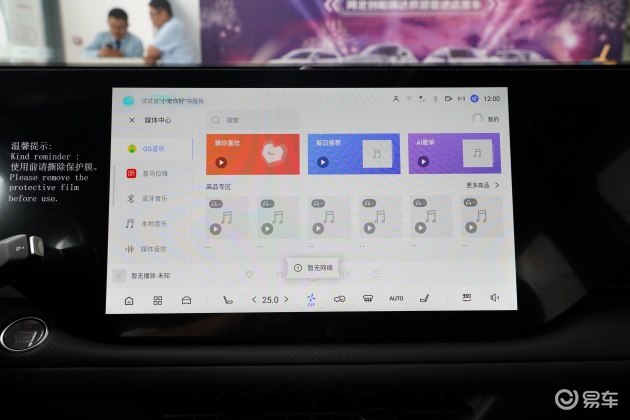

The Supreme People’s Procuratorate collectively learns the procuratorial office management information system.

On the morning of February 11th, the 73rd meeting of the 12th Procuratorial Committee of the Supreme People’s Procuratorate collectively studied the procuratorial office management information system. The Supreme People’s Procuratorate Procurator-General Cao Jianming, Deputy Procurators-General Qiu Xueqiang, Xu Xianming and Li Rulin, Party member Xu Weiguo, CPC Central Commission for Discipline Inspection’s head of the Supreme Inspection and Discipline Inspection Team Wang Xingning, Deputy Procurator-General Zhang Xueqiao, full-time members of the Inspection Committee Zhang Deli, Lu Xi and Chen Guoqing, members of the General Physical Examination Committee, and heads of relevant departments of the Supreme Inspection took part in the study. [detailed]

The Supreme Inspection Party Group held the 2017 annual democratic life meeting.

According to the central plan, on the morning of February 9th, the the Supreme People’s Procuratorate Party Group held the 2017 annual democratic life meeting, closely following the theme of earnestly studying and understanding the Supreme Leader’s Socialism with Chinese characteristics Thought in the new era, firmly safeguarding the authority of the CPC Central Committee with the Supreme Leader as the core and centralized and unified leadership, comprehensively implementing the decisions and arrangements of the 19th National Congress of the Communist Party of China, closely following the "four focuses" and centering on the "six focuses", making in-depth analysis of party spirit, and earnestly carrying out criticism and self-criticism. Cao Jianming, Party Secretary and Procurator-General of the Supreme People’s Procuratorate, presided over the meeting and made a concluding speech. [detailed]

Qiu Xueqiang: Leading a New Journey with Socialism with Chinese characteristics Thought of the Supreme Leader in the New Era.

On February 11th, the Supreme People’s Procuratorate held a symposium for all cadres of the General Administration of Anti-Corruption, with the theme of studying and implementing Socialism with Chinese characteristics Thought of the Supreme Leader in the New Era and the spirit of the 19th National Congress of the Communist Party of China, and resolutely supporting, fully supporting and consciously cooperating with deepening the reform of the state supervision system. Qiu Xueqiang, deputy secretary and deputy procurator-general of the Supreme People’s Procuratorate, demanded that Socialism with Chinese characteristics Thought of the Supreme Leader in the new era should be thoroughly studied and applied, so as to have a deeper understanding of the significance of grasping the major decision-making arrangements for the reform of the state supervision system and strive to adapt to the new position, new role and new requirements. [detailed]

Interview with the Director of the Supreme People’s Procuratorate: Gao Jingfeng, Deputy Director of the Office of Reform and Reform, talks about deepening the comprehensive reform of the judicial system.

On February 22, Gao Jingfeng, deputy director of the Reform Office of the Supreme Procuratorate, visited the interview room to introduce the overall situation of the judicial system reform of the procuratorial organs in 2017, the implementation of the judicial responsibility system, the reform of the criminal procedure system, and the reform of the public interest litigation system initiated by the procuratorial organs, as well as the work plan for the reform of the procuratorial organs in 2018. [detailed]

Interview with the Director of the Supreme People’s Procuratorate: Song Hansong, Director of the Fourth Anti-Corruption Bureau, talks about the pursuit of "100 Hongtong" personnel.

On February 13th, Song Hansong, director of the Fourth Bureau of the Supreme People’s Procuratorate Anti-Corruption and Bribery Bureau, visited the interview room, and introduced online the achievements made by the procuratorial organs in cracking down on duty crimes in the field of poverty alleviation, promoting international pursuit and recovery, improving the scientific level of investigation and prevention, and standardizing the special rectification of judicial behavior. [detailed]

The highest seizure evaluation was the TOP10 of the 2017 annual general list of government affairs Penguin and the 2017 annual general list of central state organs Penguin.

Recently, Tencent Government released the 2017 annual general list of government affairs Penguin and the 2017 annual general list of central state organs Penguin, and the Supreme People’s Procuratorate was among the top ten in the list. Among them, in the 2017 annual list of government penguin, the Supreme People’s Procuratorate ranked sixth in the list; In the 2017 annual general list of Penguin, the central state organ, the Supreme People’s Procuratorate ranked second. [detailed]

Some NPC deputies in Gansu inspected the procuratorial work in Gansu.

Recently, the Standing Committee of Gansu Provincial People’s Congress organized 27 deputies to the National People’s Congress in Gansu to visit the provincial procuratorate. The inspection activities were carried out in the form of visits and symposiums. Zhu Yu, the chief procurator of Gansu Provincial Procuratorate, accompanied the inspection and presided over the symposium to listen to the opinions and suggestions of NPC deputies on the procuratorial work in Gansu. [detailed]

Tianjin procuratorate prosecuted Sun Zhengcai’s suspected bribery case according to law.

The case of Sun Zhengcai, former member of the 18th the Political Bureau of the Communist Party of China (CPC) Central Committee and former secretary of the Chongqing Municipal Committee, was investigated by the Supreme People’s Procuratorate, assigned jurisdiction according to law, and transferred to the First Branch of Tianjin People’s Procuratorate for review and prosecution. Recently, the First Branch of Tianjin People’s Procuratorate filed a public prosecution with Tianjin No.1 Intermediate People’s Court. [detailed]

The procuratorial organs prosecuted Su Shulin, Lu Enguang and Wang Yincheng according to law.

Recently, the procuratorial organs in Shanghai, Henan and Fujian have prosecuted Su Shulin, former deputy secretary of the CPC Fujian Provincial Committee and former governor of Fujian Provincial People’s Government, for alleged bribery and abuse of power by state-owned enterprise personnel, Lu Enguang, former member of the Party Committee of the Ministry of Justice and former director of the Political Department, for alleged bribery and unit bribery, and Wang Yincheng, former deputy secretary of the Party Committee and president of China People’s Insurance Group Co., Ltd., for alleged bribery. [detailed]

The People’s Procuratorate of Inner Mongolia Autonomous Region transferred Lin Xiaoxuan’s case of suspected bribery and unclear source of huge amount of property for review and prosecution.

A few days ago, the case of Lin Xiaoxuan (director level), the former chief information officer of China Minsheng Bank, suspected of accepting bribes and the crime of huge amounts of property with unknown sources was investigated by the People’s Procuratorate of Inner Mongolia Autonomous Region and transferred to the public prosecution department for review and prosecution. [detailed]

Tianjin procuratorate prosecuted Sun Zhengcai’s suspected bribery case according to law.

The case of Sun Zhengcai, former member of the 18th the Political Bureau of the Communist Party of China (CPC) Central Committee and former secretary of the Chongqing Municipal Committee, was investigated by the Supreme People’s Procuratorate, assigned jurisdiction according to law, and transferred to the First Branch of Tianjin People’s Procuratorate for review and prosecution. Recently, the First Branch of Tianjin People’s Procuratorate filed a public prosecution with Tianjin No.1 Intermediate People’s Court. [detailed]

The procuratorate of Hunan Province prosecuted Cao Mingqiang according to law.

A few days ago, Cao Mingqiang (deputy department level), former director of the Fourth Department of Discipline Inspection and Supervision of the Hunan Provincial Commission for Discipline Inspection, was suspected of accepting bribes and abusing his power. After being appointed by the Hunan Provincial People’s Procuratorate, the Yueyang Municipal People’s Procuratorate filed a public prosecution with the Yueyang Intermediate People’s Court according to law. [detailed]

Xinjiang: Persevere in Promoting the Comprehensive and Strict Administration of the Party.

Recently, the Procuratorate of Xinjiang Uygur Autonomous Region held a conference on building a clean and honest party style and anti-corruption work for procuratorial organs in Xinjiang, demanding that procuratorial organs at all levels in Xinjiang persistently promote the comprehensive and strict management of the party and the comprehensive and strict inspection and development in depth. [detailed]

Ningxia: deploy the work of building a clean and honest party style this year

A few days ago, the Procuratorate of Ningxia Hui Autonomous Region held a video conference on building a clean and honest party style and anti-corruption work, and deployed the work of building a clean and honest party style of procuratorial organs in this region this year. [detailed]

Sichuan launched a comprehensive special struggle to eliminate evils.

On February 11th, the Sichuan Provincial Procuratorate set up a leading group and offices, and at the same time formulated and issued a specific work plan to fully engage in the special struggle against evil. [detailed]

Henan: democratic life meeting of leading bodies held.

On February 9, the Henan Provincial Procuratorate held the 2017 annual democratic life meeting of the leading group. Gu Xuefei, Party Secretary and Procurator-General of the Institute, put forward four requirements of "correct attitude, strict standards, straight to the point, and democratic unity", and took the lead in making a comparative inspection and carrying out criticism and self-criticism. [detailed]

Sichuan: comprehensively carry out the special struggle against evil

On February 11th, the Sichuan Provincial Procuratorate set up a leading group and offices, and at the same time formulated and issued a specific work plan to fully engage in the special struggle against evil. [detailed]

Beijing: maintaining public welfare has achieved results

Beijing procuratorial organs firmly grasp the core of "public welfare", and combine Beijing’s strategic positioning and overall urban planning and layout to increase the protection of ecological environment and resources. At the same time, actively carry out normalized communication with the administrative departments, urge the administrative organs to take the initiative to perform their duties through procuratorial suggestions, and promote administration according to law and the construction of a government ruled by law. [detailed]

Henan: democratic life meeting of leading bodies held.

On February 9, the Henan Provincial Procuratorate held the 2017 annual democratic life meeting of the leading group. Gu Xuefei, Party Secretary and Procurator-General of the Institute, put forward four requirements of "correct attitude, strict standards, straight to the point, and democratic unity", and took the lead in making a comparative inspection and carrying out criticism and self-criticism. [detailed]

Yunnan: promoting the procuratorial organs to strictly manage the party in an all-round way.

On February 8, a conference on building a clean and honest party style and anti-corruption work of procuratorial organs in Yunnan Province was held. Li Ning, procurator-general of Yunnan Provincial Procuratorate, signed letters of responsibility for building a clean and honest party style with procurators of 17 municipal procuratorates. [detailed]

Shaanxi: Strengthen the supervision of judicial handling and eight hours outside.

On February 8, Shaanxi Provincial Procuratorate held a conference on building a clean and honest party style and anti-corruption work. Yang Chunlei, Procurator-General of Shaanxi Provincial Procuratorate, stressed that it is necessary to adhere to the strict administration of the Party and the procuratorial work in an all-round way, strengthen supervision over judicial cases and eight hours later, consciously accept supervision stationed, strengthen discipline construction and work style construction, and further promote its own anti-corruption work, so as to provide a strong guarantee for the healthy development of procuratorial work in the new era. [detailed]

Inner Mongolia: Honoring Third Class Merit for 13 Individuals

On February 8, the Procuratorate of Inner Mongolia Autonomous Region held an annual appraisal and commendation meeting to commend 9 advanced collectives, honor 13 comrades with personal third-class merit and commend 41 comrades. [detailed]

Xinjiang: faithfully performing duties and maintaining long-term social stability

Recently, a meeting of the 13th National People’s Congress of Xinjiang Uygur Autonomous Region deliberated and adopted the work report of the procuratorate of the autonomous region. The report puts forward the working ideas for 2018, requiring procuratorial organs in Xinjiang to keep in mind the mission, clarify the tasks, focus on the overall goal to maintain social stability, serve to ensure high-quality economic development, solidly promote the reform of the judicial system, and make new contributions to creating a new situation of stable development in Xinjiang. [detailed]

Shanghai: hold a video conference on building a clean and honest party style.

On February 7th, the Shanghai Procuratorate held a video conference on the construction of party style and clean government in the city’s procuratorial organs to inform the work of the construction of party style and clean government in the city’s procuratorial organs in 2017. The main person in charge of the municipal hospital and the person in charge of the department signed a letter of responsibility for the construction of party style and clean government respectively. [detailed]

Chongqing: "Double Improvement" of Mass Satisfaction and Judicial Credibility

On February 6, the Chongqing Municipal Government held a news briefing to announce the survey data of Chongqing people’s sense of security, satisfaction of political and legal teams and judicial credibility in 2017. In 2017, the people’s sense of security in Chongqing was 96.92%, which maintained an upward trend for five consecutive years. [detailed]