[Zhongguancun Online] Xiaomi’s evaluation: The word "machine emperor" has not been used since the decline of Nokia. This time Xiaomi is trying to pick up this crown through Xiaomi’s top version, and 2999 also makes it the most expensive in history, with 3,000 yuan. The cautious Lei Jun finally did not dare to cross the line. From the configuration point of view, Xiaomi Top Edition does have the potential to compete for the Android machine emperor, but the era of Nokia’s "Spring and Autumn Five Overlords" has long passed. Feelings, fans and small beauty and sales are king. After Xiaomi has set a guarantee of 100 million sales, you will find that Xiaomi Top Edition is not a good player. Why do you want to win the hat of "Android Machine Emperor"? It is nothing more than the root of its life-"born for a fever" can’t be lost. From the slogans of "continue to have a fever" and "have a fever to the end", you should understand that Xiaomi needs a platform for fans and himself that can be called "machine emperor".

Can you win the Android King? Xiaomi Top Edition Evaluation

This is the top version of Xiaomi. Although there is no change in appearance from the standard version of Xiaomi, it is undeniable that it is the most beautiful mobile phone of Xiaomi, even if it is taken out, it is not inferior to other brand products. If Xiaomi used to beat the world with fever and price/performance ratio and MIUI, Xiaomi at least made up the short board of Yan value. In order to reflect its status as a machine emperor, Xiaomi abandoned the traditional yellow environmental protection packaging and specially designed the distinguished black version, which was considerate to enhance his worth.

Both sides of the material are made of Corning Gorilla’s third-generation glass, which is obvious to all. However, because the back glass is smooth and has no resistance, it is easy to fall on an angled desktop or book. If you are not at ease, it is recommended to use a protective cover. Compared with the standard version, the Xiaomi top version is coated with a unique champagne gold color, which is closer to the true color of gold than the new gold color.

Xiaomi ding Pei ban

Xiaomi top version VS

The key word of Xiaomi Top Edition appearance is curved glass.This year’s glass wind Xiaomi followed in time. The 2D front panel glass and 3D curved glass back cover, together with aluminum alloy metal frame, basically laid the foundation for Xiaomi’s top version, and the face value was not much different. However, it does take a lot of effort to create the texture of the product. The process of 3D curved glass is extremely difficult, and it needs to be carved by machine tools, polished six times, preheated four times and finally shaped at high temperature, and finally the glass gets an excellent feel. The wrapped metal frame is also improved a lot compared with the previous generation, CNC trimming is no longer conspicuous, and the two materials of metal and glass are closely nested with each other, and the workmanship is in the middle and upper reaches.

Xiaomi ding Pei ban

Xiaomi ding Pei ban

Different from the same 3D curved glass, the combination of Xiaomi top plate glass and metal is not so friendly and natural, and the back is deliberately touched and has a heavy cutting feel. This is the only place where Xiaomi top plate is not satisfied in my hand.

Millet top matching corner cutter

Xiaomi top layout configuration

Screen keywords: 2K screen+sunshine screen technology

Compared with the standard version, the first upgrade of the top version is the screen. The screen resolution with Sharp /JDI deep customization is improved from 1080P to 2K, and the PPI is as high as 515. Xiaolong 810 with 2K screen has basically become the flagship standard. Although the 2K screen and 1080P screen have not changed much visually, as a top-equipped mobile phone, 2K can better reflect the advantages of Xiaolong 810.

5. Screen

Xiaomi, who likes soaring new words, uses three technologies for this screen: negative LCD technology+high color saturation technology+sunshine screen technology.

Negative LCD technology, which is scary to read, is actually an improvement in LCD technology. Most LCD products use positive LCD screens. The liquid crystal particles of the positive liquid crystal panel are arranged vertically. When the screen displays black, because the backlight system is still working, a lot of light will pass through the two ends of the liquid crystal particles, causing the screen display to be "gray". The advantage of the negative liquid crystal technology is that the horizontal liquid crystal particles block most of the light when the liquid crystal particles are not energized, and the screen’s performance to black is closer to the off-screen state. When the liquid crystal particles are electrified, they deflect to the vertical direction, and more light passes through, so the details of the bright part of the image become more prominent. Xiaomi Top Edition also uses UV Align technology, which makes the liquid crystal cell display black more thoroughly, and at the same time achieves an ultra-high contrast ratio of 1400:1.

2K screen

Another advantage is that the overall voltage level of the screen is more stable, which is of great benefit to the life of the screen. Moreover, because there is no need for high-power backlight, the heat and power consumption of the screen will be reduced, which can be regarded as a compensation for Xiaomi top version with 2K screen. In fact, this beautiful and power-saving screen was used as early as Meizu MX4 and Huawei Glory 6 Plus.

High color saturation technology:

High color saturation technology has been used since Xiaomi 3. This highly talked about ultra-high color saturation technology is once again reflected in Xiaomi Top Edition, reaching 95%NTSC color gamut. High color saturation means that we can get more colors from the screen.

Sunshine screen technology:

Xiaomi Sunshine Screen technology is the most intuitive function we see, which supports dynamic contrast adjustment at pixel level. When we appreciate some photos with insufficient light and dark saturation, the screen will automatically correct the display, which is similar to the familiar HDR function, and can fully show the screen display effect of Gao Fancha. At the same time, the display effect of this screen in the sun is clearer, and the power saving effect is better, saving about 30% compared with the traditional screen.

2K screen

In daily use, the positive screen can optimize the contrast in the local area of the picture, so that the details can be better presented; Improve readability under strong light, and we don’t need to manually adjust brightness. Let’s learn about the sunshine screen through a video:

Sunshine screen demonstration video

The sunshine screen adopts the Local tone mapping algorithm, and counts and calculates each frame displayed on the screen, which can be completed within 16ms, thus realizing almost real-time dynamic adjustment of the content displayed on the screen. You will find that when the light is close to the sensor, the screen will automatically repair the picture, and this response speed is more obvious under strong light.

On the screen, Xiaomi’s top version didn’t throw a 2K screen rudely. At the same time, Xiaomi also reformed the power consumption of the screen. The addition of negative LCD technology and sunshine screen made the display effect a bright spot. Finally, the mobile phone also added an eye protection mode to reduce the blue light source and brightness of the screen separately, thus reducing visual fatigue.

Photograph: Compare Plus and S6 Edge.

The residue of the previous generations of Xiaomi’s photo effect is obvious to all, which has become a very dark handle that he does not want to let go. The Xiaomi Top Edition retained the 13-megapixel camera from Xiaomi 3, because it finally realized that the high-pixel sensor could not determine the quality of the photos. For this reason, OIS optical image stabilization and 14-bit image processor were added to the top edition, and the dark image quality was enhanced at the same time. Lei Jun even challenged a Plus, and made a comparison from the appearance image quality test of MTF resolution and SNR respectively:

Image quality comparison (picture quoted from Sina Weibo)

Image quality comparison (picture quoted from Sina Weibo)

Many mobile phones will challenge Apple when they are released, but we all know that the parameters and tests do not represent the final imaging quality. Here are two indoor proofs to test Xiaomi Top Edition and iPhone6 Plus:

Xiaomi Top Edition (left) VS 6 Plus (right) Click to enlarge.

The photos taken by Xiaomi Top Edition are warmer in color, but closer to the real color. Because Xiaomi camera has higher pixels, it retains more details. From the perspective of tolerance, the light-dark transition range of Xiaomi top version is wider, which also explains the convex and concave parts of the cactus. Xiaomi top version can clearly see the details, while iPhone6 Plus lost this part of the details due to the excessive contrast. However, the overall color of the Xiaomi Migao version is too dull, which makes some over-optimized iPhone6 Plus look better visually.

Next, let’s try the photo effects of Xiaomi Top Edition and Popular Machine Emperor, which are also two proofs in the same environment.

Xiaomi Top Edition (left) VS (right) Click to enlarge.

From this point of view, the top version of Xiaomi has a higher degree of restoration, but there is more noise in dark places such as the ceiling. Edge intends to improve the brightness in the later stage, so we can see that its dark details are better, and it also occupies a certain advantage. The details are better, and the optimized picture is cleaner, but the true degree of restoration is not as high as a meter.

This time, Xiaomi highlighted its dark-light photography technology. In the later optimization, it added the noise reduction technology based on intelligent multi-frames. In the dark environment, it continuously took three pictures and conducted intelligent analysis and noise reduction, which finally made the photos bright as a whole. We also tested its night shooting effect from several pictures:

Night proof

Night proof

Night proof

Night proof

Night proof

Night proof

Night proof

Night proof

Night proof

As can be seen from the figure, Xiaomi Top Edition has been effective in suppressing noise, and glare has also been suppressed. Although the brightness has been improved, it still needs to be improved without turning on the flash.

Here are some outdoor proofs:

Outdoor proofs

Outdoor proofs

Outdoor proofs

Outdoor proofs

Outdoor proofs

Outdoor proofs

The front camera uses a 4-megapixel camera with a large pixel of 2um, which is the largest single pixel in mainstream mobile phones at present. A larger single pixel means that more light can be received, and the brightness of image quality will be improved as a whole. The front camera is more used for self-portrait, so we still invite beautiful editors to test its self-portrait effect and compare it with iPhone6 Plus. Let’s see which one looks better.

Xiaomi top version (left) iPhone6 Plus (right) selfie comparison

The camera is the key optimization function of MIUI, so in addition to the post-optimization when taking pictures, this Xiaomi Top Edition has also added a number of humanized functions. The author picks out several highlights and recommends them to everyone.

The first is the fill-light mode for night-light photography. If you are in the dark, MIUI will automatically bring up the flash mode when taking pictures, and you can directly choose to automatically turn on the light, which saves you a step and does not need to stop to turn on the flash. In addition, the constant light mode is added to the flash mode, which can be used as supplementary light in dark light to avoid underexposure in flash.

Flash fill light mode

Second: peak focusing: a function in the SLR camera is transplanted to the mobile phone. When it is used, you can see the peak focusing option when you turn on the manual mode. When you focus manually, the camera will automatically paint the objects that have been focused, so that we can clearly see which objects have been focused when taking pictures, so as to avoid out-of-focus phenomenon, but it is of little use in real life, so you can have a taste.

Peak focusing

Level function

Third: Level: Using the fact clipping function, the photos in the view frame can always be kept in a horizontal state, which is very useful for some obsessive-compulsive patients. People may seldom pay attention to this point in daily use, and it is also a good function if necessary.

Configuration: 20nm Xiaolong 810+LPDDR4 4G storage.

For enthusiasts, the running memory of Xiaolong 810 and 4GB is the G point of their climax, but it was once known as "the fastest computing speed in the world", and Xiaomi did not take the lead in Xiaolong 810 and 4GB memory. At least it has been proved that Xiaomi is no longer trying to prove that he is the first in performance like a young man, and he is beginning to mature mentally to make up for the shortcomings of performance. In addition, Xiaomi’s hottest product is not the most popular mobile phone, and the appearance of Xiaomi’s top version only meets the needs of a few enthusiasts.

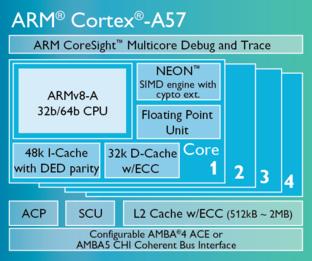

However, the configuration of the top version is still exciting. If you want to list a keyword, it should be:Xiaolong 810+8 core 64-bit++4GB memory+LPDDR 4+Adreno 430+A57+20nm process.It is these keywords that support the road of Xiaomi Top Edition to hardware fever.

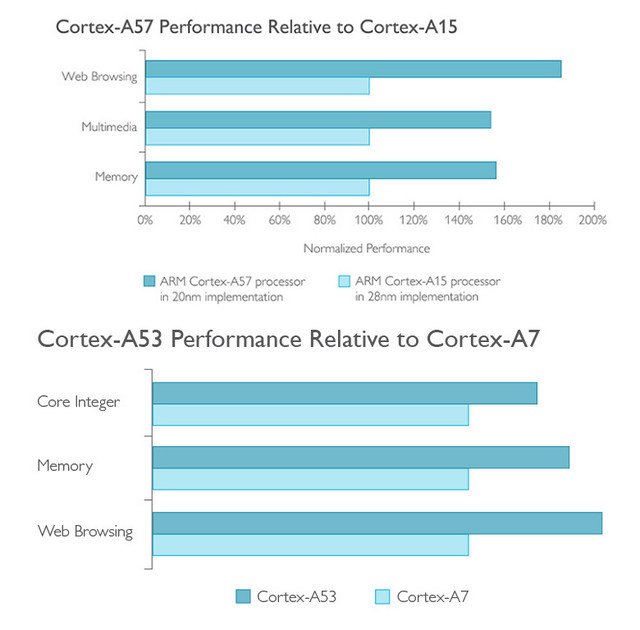

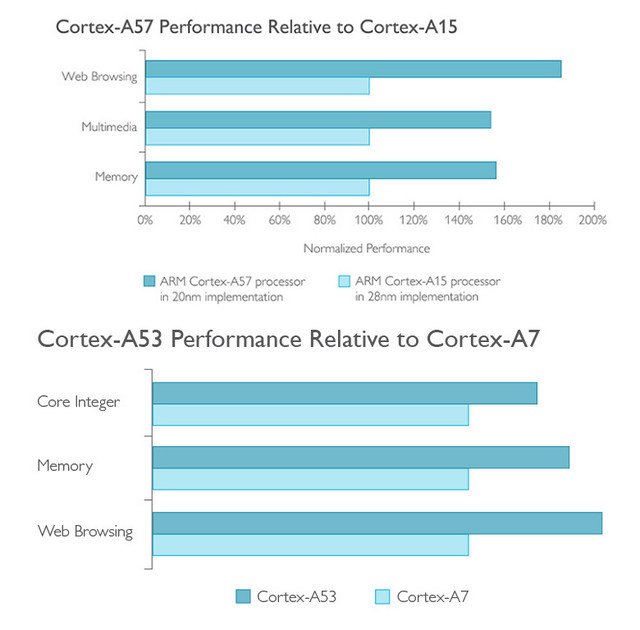

I believe you already know enough about Xiaolong 810. It adopts a new generation of 64-bit architecture, is manufactured based on a more advanced 20nm process, and draws lessons from the Big.LITTLE architecture design developed by ARM. It integrates four Cortex-A57 cores and four Cortex-A53 cores, with a maximum frequency of 2.0GHz. These two sets of CPU cores can be turned on and off intelligently according to the intensity of tasks to be handled by smart phones. When doing some operations that don’t require much hardware performance, the processor may only have one Cortex-A53 CPU core in the on state, while the other cores are in the off state, which can not only meet the performance requirements of the task process, but also save the power consumed by the processor to the greatest extent.

The performance of A57+A53 is greatly improved compared with the combination of A15+A7 (picture quoted from ARM).

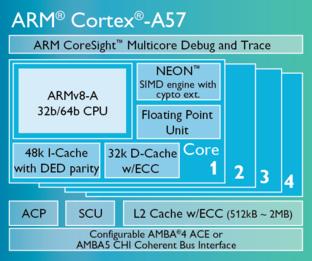

Xiaolong 810 is composed of four A57 cores and four A53 cores (picture quoted from ARM).

Compared with the previous Andreno 420, the Adreno 430 GPU core integrated by Xiaolong 810 can improve the image processing performance by up to 30%, and supports screens with 1080P, 2K and 4K resolutions. Its default working frequency is 600MHz, the pixel filling rate is 6Gpix/s, and the triangle filling rate is 500 mtri/s. It also supports ES3.1+AEP and DirectX11.2

The latest LPDDR4 standard is adopted in the memory, which is 1.7 times faster than LPDDR3, and the memory is increased to 4GB. At the same time, the reading speed of the built-in 64GB eMMC 5.0ROM is twice that of eMMC4.5.

Running performance also exceeded 60,000:

Antu rabbit runs away.

4GB of memory brings us a smoother experience, but the author also found that it is the same Xiaomi series, but the memory occupation of different versions is different. When the background is turned off, the remaining memory of 3GB of Xiaomi Standard Edition is 1.2G, while that of 4GB of Xiaomi Top Edition is GB1.6, and 4GB of memory does not bring more remaining space to Xiaomi Top Edition. In addition, before brushing this small memory application, Xiaolong 810 and Snapdragon 801 have little performance in speed, which can also be clearly seen from the video.

Left Xiaomi Top Edition VS Right Standard Edition

The performance advantage of Xiaolong 810 needs large-scale games to play better, but it also involves the issue that everyone is most concerned about: fever. Samsung once unsubscribed from the chip because of the fever problem of Xiaolong 810. The Xiaolong 810 used in the Xiaomi top version is already the third version. So how does this third version of Xiaolong 810 perform in heat dissipation control?

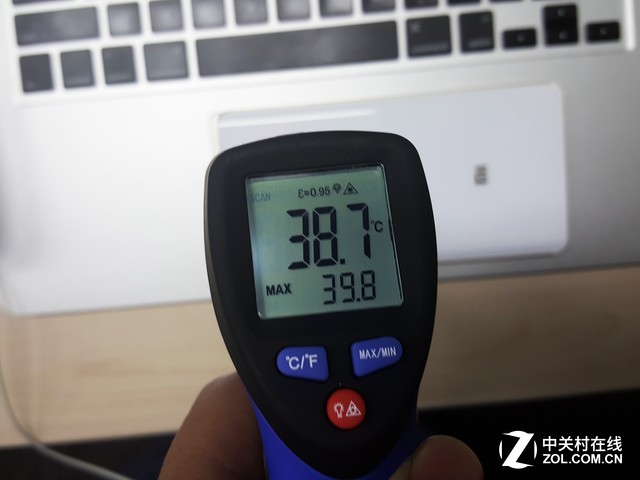

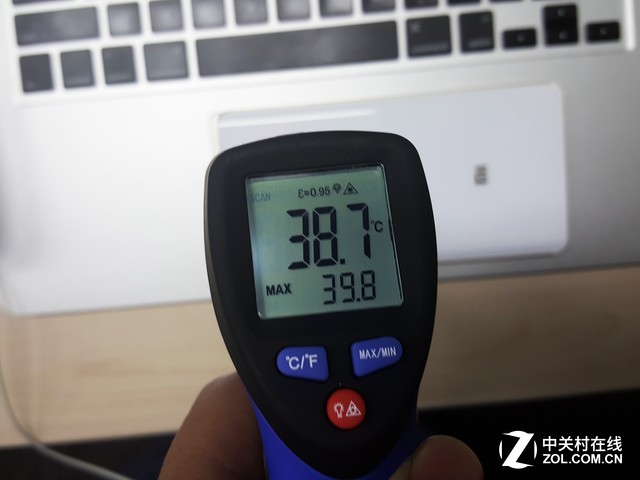

Xiaomi himself also tested the heat dissipation performance, playing large-scale games for 20 minutes, and the main area on the back of the mobile phone was about 36.3 degrees. We retested the authenticity of this data, and chose ""for the test and tried it for 30 minutes.

Heat dissipation test

As can be seen from this picture, after running a large game for 30 minutes, the surface temperature of the fuselage is close to 40 degrees at the highest, with an average of about 38 degrees, which is in line with the previous test performance of Xiaomi.

In fact, Xiaomi is prepared for the heat dissipation of Xiaolong 810. The first is to optimize the frame structure of the fuselage to make the overall heat dissipation uniform. In the actual test, the author also found that the processor part has started to heat up after 5 minutes of trial play, but in the following time, the heat is transferred to the whole glass panel, which also proves that the overall heat dissipation design is effective. In addition, Xiaomi also added four graphite fins to expand the heat dissipation efficiency. It is this series of improvements that make Xiaomi Top Edition effectively control the fuselage temperature.

Other highlights include the Sensor Hub coprocessor, similar to the coprocessor, which is used to help realize data processing of gyroscopes, acceleration sensors, geomagnetic sensors, etc., so as to reduce the burden of the main processor and thus achieve the effect of reducing power consumption. The whole series of Xiaomi also adds air pressure sensor, which can display air pressure and altitude in real time in the application of real compass.

HiFi music: ES9018K2M chip+double clock crystal oscillator

Another improvement of Xiaomi Top Edition is aimed at the improvement of HiFi music system. Eight Panasonic audio capacitors are added in the new version to further improve the purity of sound quality, and stable power supply is realized through two-stage linear power supply to achieve stronger transient response. In the HiFi music system with Xiaomi Top Edition, Xiaomi MIUI system also rewrote the underlying audio of Android.

Xiaomi ding Pei ban

Key words of HiFi system: ES9018K2M audio chip+secondary operational amplifier+double clock crystal oscillator+secondary power supply+8 Panasonic PPS audio capacitors.

From the point of view of hardware stacking, Xiaomi Top Edition is undoubtedly the most ruthless one in HiFi music at present, and the hammer has been compared with the hardware. For example, the dual-clock crystal oscillator has no obstacle in the face of sampling rate conversion distortion; The format supports multi-system lossless music decoding, including APE, ,Wave and DSD;; Newly added two-stage regulated power supply and eight Panasonic PPS audio capacitors make the mobile phone have further performance in transient response and sound purity.

Xiaomi Top Edition also has built-in lossless music. In the audition, Xiaomi Top Edition can hear more details, and the sound quality is low and soft, just like being there. However, for most non-HiFi enthusiasts, it is still a question whether HiFi can drive them to make large-volume lossless music.

Summary: How far is Xiaomi Top Plate Matching Machine Huang Road?

Xiaomi Top Edition is equipped with MIUI 6 version developed based on Android5.0.2. We have already introduced MIUI 6 in many details, so I won’t repeat it here. Personally, I think MIUI V6 is the best one among many deeply customized Roms based on Android. If you are not a fruit powder or a Google powder, MIUI is actually very suitable for Chinese users, and its continuous update also provides more possibilities for optimization.

Xiaomi Top Edition on the Internet is not a full netcom product. Although it is a dual-card dual-standby design and supports mobile and Unicom dual 4G, it is still a miss for telecom users. Cato designed Xiaomi Top Edition to support Micro-SIM card and Nano-SIM card, which can be directly inserted by both mainstream Android and users without cutting cards, which is commendable.

Xiaomi ding Pei ban

As we mentioned earlier, Xiaolong 810 also adopts the LTE support of Cat.9 standard of carrier aggregation III, which can achieve three times faster than Cat.4, up to 450Mbps. While greatly improving the network speed, Xiaolong 810 also has complete global LTE coverage: it not only widely supports LTE/3G standards and frequency bands, but also realizes LTE high-speed connection when roaming, and falls back to 3G networks where there is no LTE coverage.

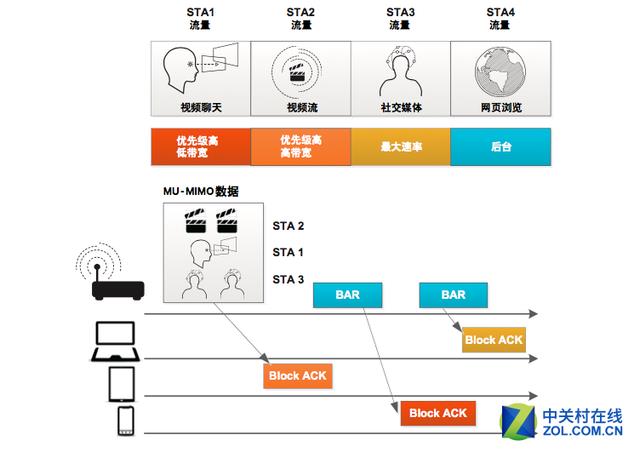

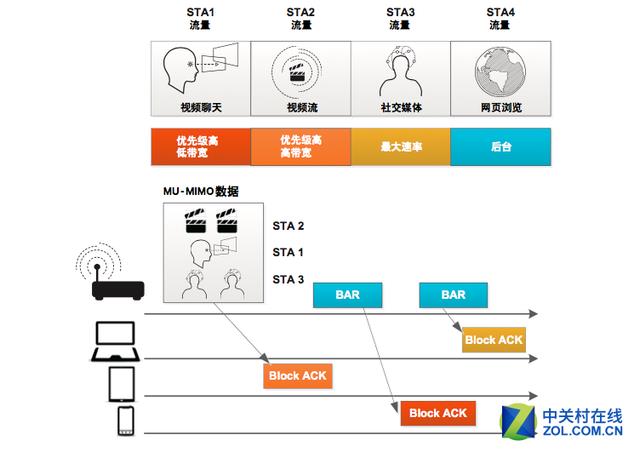

In addition, Xiaomi also applies MU-MIMO multi-connection concurrent technology, which is the most advanced Wi-Fi protocol at present, and can solve the problem of transmission rate drop caused by multiple devices in the same network environment. In this network protocol environment, it can be three times faster than others.

MU-MIMO data transmission

MU-MIMO data transmission

In terms of battery, the Xiaomi top version has been upgraded from the standard version of 3000 mAh to 3090 mAh. In addition, two charging modules have been added on the basis of fast charging. Using fast charging 2.0 technology, 9V1.2A charging technology can charge about 75% in one hour. Using dual charging modules, it can charge quickly and ensure uniform heat dissipation, which reduces the instability caused by temperature.

Summary: Back to the question mentioned in the title, can Xiaomi Top Edition win the title? I believe that different people already have their own answers. Machine King is not a simple pile of hardware. Xiaomi’s advantage lies in MIUI. MIUI 6 has successfully transformed into a lightweight system, and it is also a ROM; suitable for most Chinese people. On the face value, Xiaomi has proved himself from the double-sided glass process, but there are also many face value mobile phones in the same position as Xiaomi, and Xiaomi is not the most beautiful; The standard of taking pictures has been greatly improved, but there are countless main camera phones, and Xiaomi is not the best; HiFi music and processor memory can be called top-notch, which is rare and has obvious price advantage. Generally speaking, Xiaomi Top Edition is a seed player with an average advantage. It may be the current Android machine king, but now the mobile phone technology is updated too fast, and the Xiaomi Top Edition with fingerprint recognition and borderless technology is not available. So, who knows how long this machine king’s hat will last?

The above is a report on Xiaomi Note product evaluation. For the follow-up content of Xiaomi Note, such as appearance, screen, photo, battery life and performance, please continue to pay attention to Zhongguancun Online’s report on Xiaomi Note evaluation.

MU-MIMO data transmission

MU-MIMO data transmission